In order to provide accurate and reliable information It is crucial to examine the sources and data that are used by AI stock prediction and trading platforms. A poor quality data source can lead to incorrect predictions, loss of money, and a lack of trust. Here are the top 10 suggestions for evaluating the quality data and its sources.

1. Verify the data sources

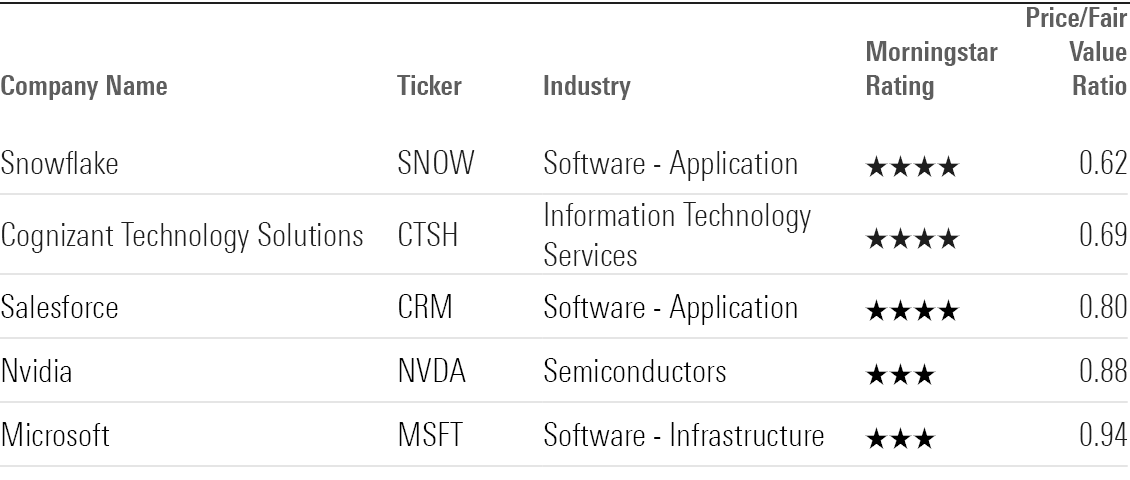

Check the source of the data. Make sure the platform is using trusted and reliable data providers, such as Bloomberg, Reuters or Morningstar.

Transparency. A platform that is transparent will disclose all its data sources and update them regularly.

Avoid dependency on one source: Trustworthy platforms often aggregate data from several sources to reduce bias and errors.

2. Examine the freshness of data

Real-time vs. delayed data: Decide whether the platform is providing real-time data or delayed data. Real-time information is essential for active trading. Data that is delayed can be sufficient for long term analysis.

Update frequency: Check if the information is updated.

Historical data consistency: Check that historical data is free of gaps and anomalies.

3. Evaluate Data Completeness

Look for missing data.

Coverage - Make sure the platform you select is able to cover all the stocks, indices and markets relevant to trading strategies.

Corporate actions: Verify that the platform includes stock splits (dividends) and mergers as well as any other corporate actions.

4. Accuracy of Test Data

Cross-verify the data: Compare data on the platform against data from other sources you trust to ensure that the data is consistent.

Error detection: Search for a mismatch in pricing, incorrect financial metrics, or other outliers.

Backtesting: You can utilize historical data to test strategies for trading. Check if they match your expectations.

5. Examine the Data Granularity

Level of Detail: Make sure the platform is able to provide detailed data, such intraday pricing, volume, bidding-asking spreads and order book depth.

Financial metrics: Find out whether your platform has complete financial reports (income statement and balance sheet) as well key ratios such as P/E/P/B/ROE. ).

6. Check Data Cleaning and Processing

Normalization of data is crucial to ensure consistency.

Outlier handling - Verify the way the platform handles anomalies and outliers.

Imputation of missing data is not working - Make sure whether the platform uses effective methods to fill in missing data points.

7. Check for Data Consistency

Timezone alignment Data alignment: align according to the same timezone to avoid any discrepancies.

Format consistency: Ensure that data is presented with a consistent format.

Cross-market uniformity: Make sure that data from different exchanges or markets are in harmony.

8. Assess Data Relevance

Relevance in trading strategy. Ensure that the data aligns to your trading style.

Features selection: Check that the platform offers relevant features to enhance forecasts (e.g. sentiment analysis, macroeconomic indicator news information).

Check the integrity and security of your data

Data encryption: Make sure that the platform is using encryption to protect data when it is transmitted and stored.

Tamper proofing: Ensure that the data on the platform isn't being altered.

Compliance: Verify that the platform is compatible with any data protection laws (e.g. GDPR or CPA, etc.).

10. Transparency in the AI Model of the Platform is tested

Explainability: Ensure that the platform offers insight on how the AI model uses the data to generate predictions.

Find out if the system has an option to detect bias.

Performance metrics: To assess the reliability and accuracy of predictions, analyze the platform's performance metrics (e.g. accuracy, precision, recall).

Bonus Tips

Reviews from users: Read user reviews of other users to gauge of the quality and reliability of the data.

Trial period: Use an unpaid trial or demo to check the platform's data quality and features prior to signing.

Customer support: Ensure that the platform provides a robust support for customers to address data-related issues.

These tips will help you better assess the sources of data as well as the quality of AI platform for stock prediction. You will be able to make accurate and informed decisions about trading. Have a look at the best cool training about best AI stock for blog advice including ai for stock trading, best AI stock, ai for investment, AI stock trading bot free, chatgpt copyright, ai trading, ai trading, investment ai, incite, best ai trading app and more.

Top 10 Tips On Assessing The Transparency Of AI stock Predicting Trading Platforms

Transparency is a critical element when it comes to evaluating AI-driven stocks prediction platforms and trading platforms. It allows the user to trust a platform's operation, understand how decisions were made and to verify the accuracy of their predictions. These are the top 10 tips for assessing transparency in such platforms.

1. AI Models are explained in depth

TIP: Make sure the website provides a comprehensive explanation of the AI algorithms that are used to predict the future.

Why: Users can better assess the reliability and limitations of a system by knowing the technology behind it.

2. Disclosure of data sources

Tip

The reason: Understanding the data sources ensures the platform uses credible and comprehensive information.

3. Performance Metrics and Backtesting Results

TIP: Look for clear reporting on the performance metrics like accuracy rate, ROI and backtesting.

Why: It lets users verify the performance of their platform in the past and also to verify the effectiveness of their system.

4. Real-Time Updates and Notifications

TIP: See if you can get real-time notifications and updates about trades, predictions or modifications to the system.

The reason is that real-time transparency provides users with constant details about crucial actions.

5. Limitations - Communication that is open

TIP: Make sure that the platform outlines its limitations and risks in relation to forecasts and trading strategies.

What's the reason? Acknowledging limitations builds trust and allows users to make informed choices.

6. User Access to Raw Data

Tip: Find out if you are able to access raw data, or the intermediate results AI models utilize.

How do they do it? Users are able to perform their own analysis and test their theories by accessing the data in its raw form.

7. Transparency in the way fees and charges are disclosed.

Be sure that the platform provides every cost that are due, including subscription fees and any other hidden costs.

Transparent pricing builds confidence and avoids unexpected costs.

8. Regularly scheduled reporting and audits

Find out if the platform produces regular reports, or undergoes audits by third party auditors to check its performance.

Why independent verification is important: It increases credibility and accountability.

9. Predictions that can be explained

Tip: Determine if the platform can explain the process by which it comes up with specific predictions or suggestions (e.g. decision trees, the importance of features).

Explainability is a tool that helps users to understand AI-driven decision making.

10. User Feedback Channels and Support

TIP: Make sure that the platform provides open ways to receive feedback and assistance from users, and whether they provide a clear response to users' concerns.

Why: Responsive communications demonstrate the commitment to transparency and user satisfaction.

Bonus Tip: Regulatory Compliance

Make sure the platform adheres and is clear about its compliance with the financial regulations. This increases the transparency and credibility.

If you take the time to carefully examine these factors you can evaluate whether an AI-based stock prediction and trading system operates transparently. This lets you make informed choices and gain confidence in its capabilities. Have a look at the top stock trading ai for site recommendations including free ai tool for stock market india, stock trading ai, AI stock trader, ai investment tools, AI stock prediction, ai for trading stocks, trading ai tool, ai copyright signals, ai for trading stocks, stock predictor and more.